Whatever Happened to The Internet of Things?

I'll Keep This Short

It's a crisp, autumn morning in 2015 as you walk towards your WeWork office, the tangible force of mid-2010's wealth and excess pulsing through the streets. As you enter the building, the scent of coffee fills your nostrils, mixed with the faint aroma of freshly printed low-interest money. Hooded UX managers talk and openly sneeze showers of visible droplets into the air without even a hint of consciousness of social distancing. They squint at their iPhone 6's faces flushed as they shout about the promise of the Internet of Things. Whatever happened to the Internet of Things? Did it get swept away like so many hapless Silicon Valley bank clients? Or has the Internet of Things continued to have its day in the sun as we get distracted with other shiny objects?

Prediction Markets Approach

The Internet of Things (IoT) is kind of a difficult thing to pin down in terms of really being able to say definitively whether it has been a success or not because it has meant a lot of things to a lot of people over time. I write this as someone who co-founded and ran a fairly size-able IoT Conference from 2015-2020.

The 2019 conference had around 1300 to 1500 people or so, and then the 2020 conference converted to online due to the pandemic, and thereafter I haven’t held the conference yet. Does it make sense to try to hold it again?

I had recently wrote an article about the usage of, “Prediction Markets,” as a tool to disambiguate discussions across different opposing perspectives.

There’s a fake-money prediction platform I use called Manifold Markets which allows users to create betting markets and discuss whether a particular event will occur or not at a predetermined date. My hope in using this is to be able to delve into a particular subject and know a little bit more than I would just reading the news, or perusing social media and accepting what people say at face value. I used Manifold Markets recently to attempt to address some questions I have had about the IoT in the past couple of years, after having written about it last back in 2020.

So here is what I found using Manifold Markets to delve into the IoT question in the past few weeks…

Number of Devices

The most popular prediction market thus far in the IoT category was:

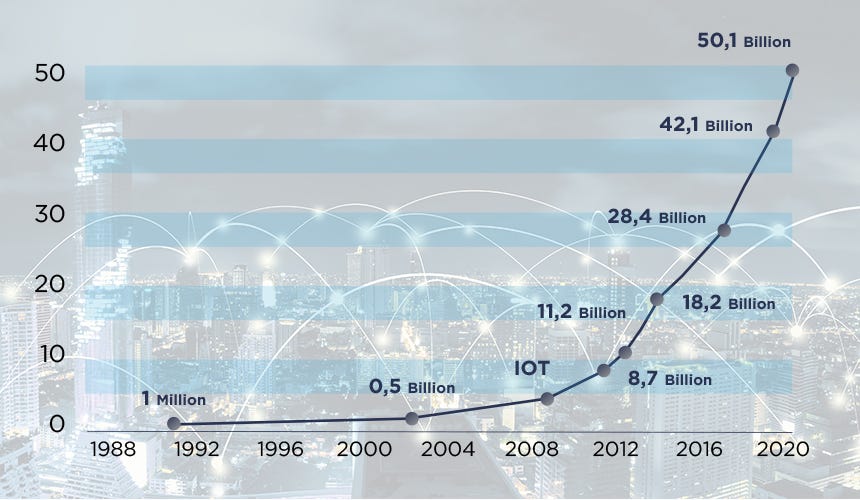

Back in those heady days of the 2010s, this type of chart would always seem to pop up, showing a sharply exponential upward curve:

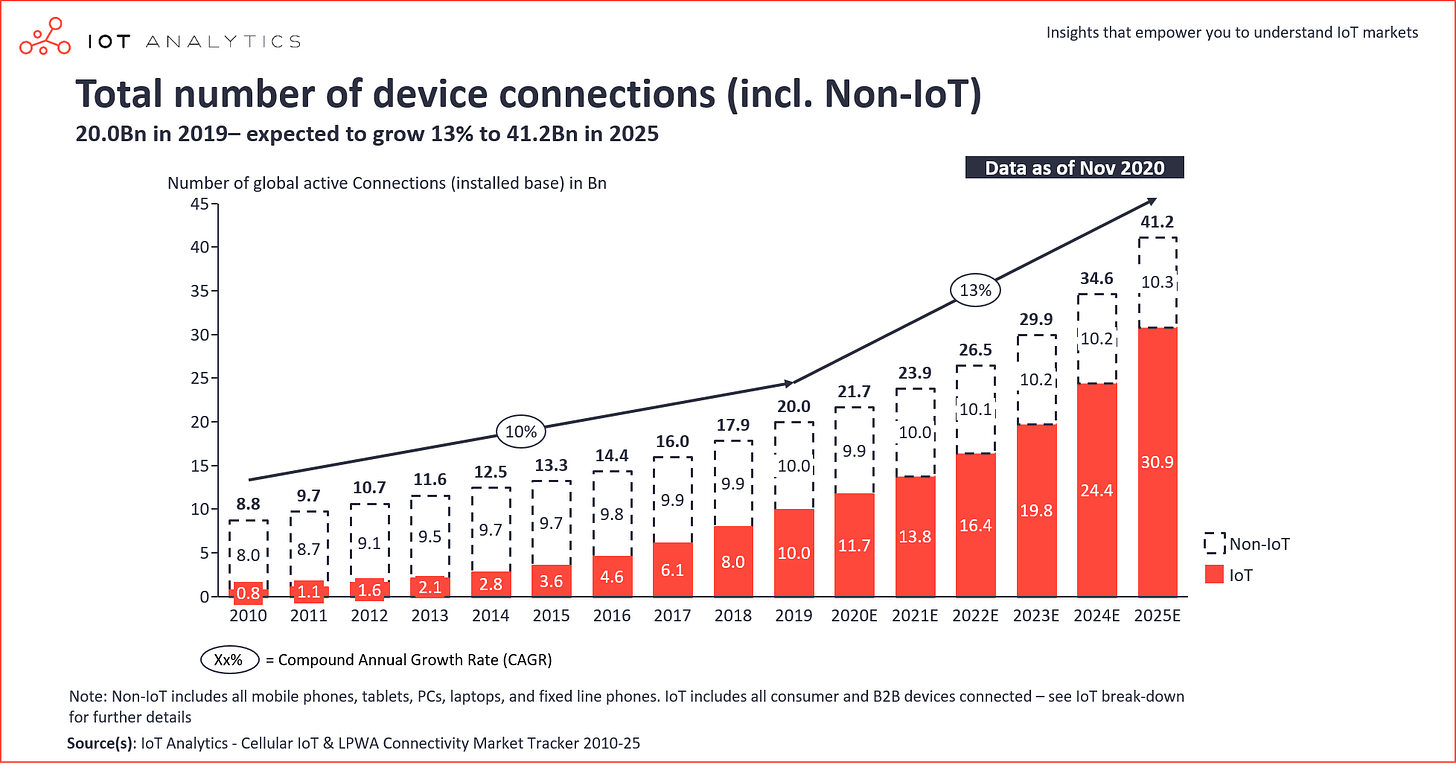

These exponential growth charts always seemed to irk me, because the end-state range result of an exponential function is pretty huge. Was there in fact 20 billion devices by the year 2020 or was there 50 billion devices? That’s a pretty huge range and it just seems like no one ever was held accountable to these predictions, which effectively meant that they were meaningless bull-crap from the standpoint of attempting to decide how to invest, to shape one’s career or make decisions about the future. Clearly we all agree that there are going to be, “more,” devices, but - why claim a hard number on a chart so forcefully?

Was there in fact 20 billion devices by the year 2020 or was there 50 billion devices? That’s a pretty huge range … which effectively meant that they were meaningless bull-crap from the standpoint of attempting to decide how to invest

So rather than just take these charts at face value, my thought with the above market is, let’s agree upon a consistent third-party metric for number of devices and follow what happens. Now, I understand what you may be thinking, “the map is not the territory,” and that’s a valid concern, but one could arguably make multiple markets upon various third-party device counting metrics and follow each of them to gain a better perspective.

Financial Benefit of The Use of Internet of Things

Second on the list of most popular markets for the Internet of Things:

Admittedly, the resolution criteria for this bet is not well-defined, being that it’s based upon a preponderance of evidence standard, rather than a third-party metric such as with the number of connected devices market above. That being said, complicating factors in this question include the fact that most of the information needed to answer this question is private, internal accounting information. To stick with the standard of being as objective as possible, I think the market maker (myself in this case), needs to be open to resolving the above as N/A, if pressed, unless a definitive third-party, objective measurement can be found.

Internet of Things as a Marketing Strategy

You certainly don’t see, #IoT on the side of a bus anymore being advertised by Oracle or Samsung or whatever, and I’m not even sure if you ever really would have seen that, but if you did, you certainly wouldn’t be seeing it in 2023.

These things are just part of our lives now. There’s not necessarily as much new money going into marketing IoT technology, because it’s just banal and normal now, it doesn’t really amaze anyone to see something like this anymore:

It’s like, “yeah, big deal, a bear at the front door — yeah we know, everyone has a door camera now, not that unexpected that you’re going to have the occasional bear and what not.”

On the other hand, surprisingly, when I created this market, I would have expected the Internet of Things search volume to have gone to the floor, but it's still somewhere around where it has been over the last 8 or so years, in terms of Google search volume at least.

As I had written back in 2020, the IoT from a marketing and awareness perspective is really just an existing term in peoples’ minds, whereas previously it wasn’t. The analogy I used for this in the past was the concept of a VPN. Whereas there used to be conferences and advertisements for the concept of a VPN as a leader 20+ years ago, now it’s just a common tool that people buy all the time. It seems that the IoT, as abstract of a concept that it is, is fitting into this category. This doesn’t mean it won’t blow up again in some form or another in the future, but the small market I created at the time of this writing, seems to think there’s only about a 1/3rd chance of that happening in the next 10 years or so.

Relative Patent Growth

Patents are a great unambiguous third-party verifiable source of information because patents are searchable by term. But that being said, there’s patent growth and there’s, “relative patent growth.” It would not have made sense for me to make a market based upon the overall patent growth of, “IoT” tagged patents because there’s a huge trend in the growth in patents overall.

So instead of measuring patent growth, we have to divide the number of patents tagged, “IoT” for each year by the total number of patents, and see whether that number increases over time. If it increased, then presumably there is a greater rate of investment specifically in IoT than all other things being patented (in the United States at least, presumably there is also a world measurement for this which could be tabulated).

Investment Sector Performance

I have two markets aimed at this question, one of which is more third-party validated, but both of which are arguably not really tracking the ground truth of the matter super well, because of the imprecise and speculative nature of investing.

Looking at how an ETF, SNSR 0.00%↑ which ostensibly tracks the IoT has performed vs. how the SP500 has performed might give some kind of sloppy insights, at least to the degree that:

This particular ETF, SNSR 0.00%↑ doesn’t over-index the SPY 0.00%↑

SNSR 0.00%↑ is actually reflective of what people think the IoT even really is.

Looking at the composition of SNSR:

Is that really what people think the IoT is? Maybe, but again, the map is not the territory. So that being said, we have a less strict definition which is based upon the “preponderance of evidence,” within submitted comments, which is much more subjective, but wider-ranging way to attempt to answer the question we’re trying to get at.

Did I Answer The Question?

Did I answer the question of, “whatever happened to the Internet of Things?” Definitively not - I instead put together a framework through which interested parties can discuss the topics based upon a centralized metric. To a certain degree, putting together a betting market is analogous to putting on an in-person conference, as I had done in the past, because it’s a meeting of the minds within a defined timeframe. Where it contrasts is the social aspect of in-person conferences is completely lost, the hallway conversations, the exchange of ideas which seems so much more, “real,” but - we do the best we can, given the times we live in.